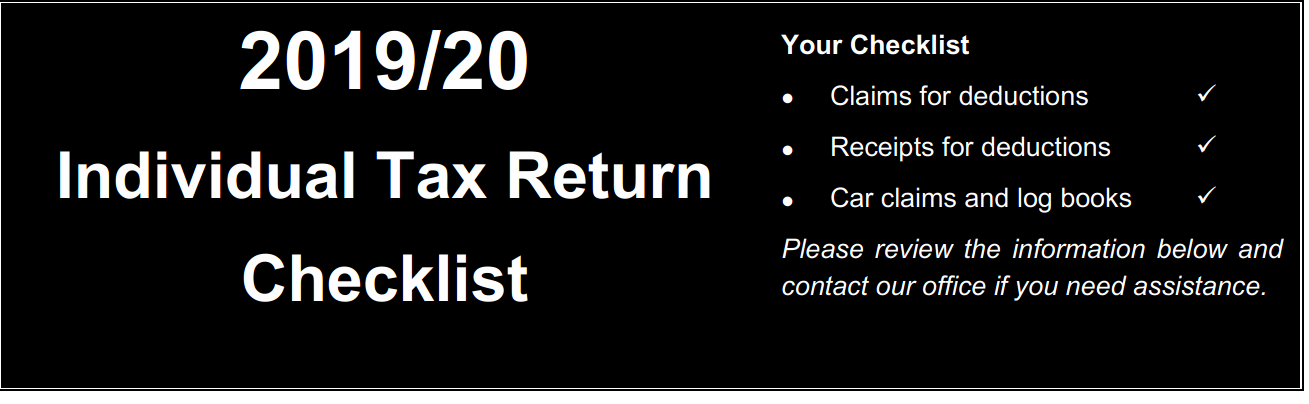

Crowley Calvert & Holmes: Tax Time is Coming

Crowley Calvert & Holmes are offering this tax-saving strategy prior to 1 July 2020.

Tax saving strategy prior to 01 July 2020.

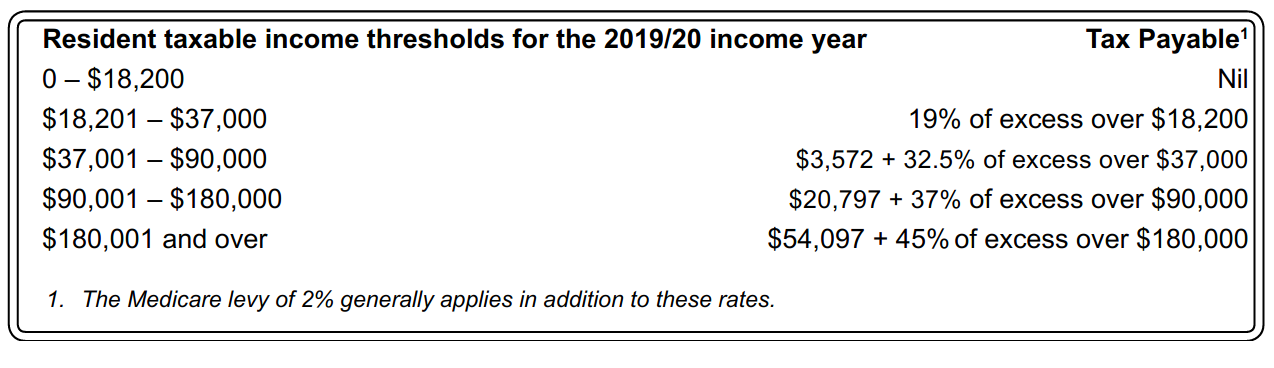

A good strategy to reduce tax payable is normally to accelerate any income tax deductions into the current income year, which will reduce overall taxable income in the current year. Despite this, for the 2020 tax season, tax planning may require consideration of an individual's potentially reduced income as a result of the COVID-19 pandemic (where applicable), in which case a decision may be made to defer expenditure.

Check out these common claims made by individuals:

The following outlines common types of deductible expenses claimed by individual taxpayers, such as employees and rental property owners, plus some strategies that may be adopted to increase deductions for the 2019/20 income year.

Depreciable plant, etc, costing $300 or less

Salary and wage earners and rental property owners will generally be entitled to an immediate deduction if certain income-producing assets costing $300 or less are purchased before 1 July 2020.

Some purchases you may consider include:

- books and trade journals;

- briefcases/luggage or suitcases;

- calculators or electronic organisers;

- electronic tablets;

- software;

- stationery; and

- tools of trade.

Clothing expenses

Individuals can purchase or pay for work-related clothing expenses prior to the end of the income year such as:

- compulsory (or non-compulsory and registered) uniforms, and occupation specific and

protective clothing; and

- other associated expenses such as dry-cleaning, laundry and repair expenses.

Self Education expenses

Individuals could consider prepaying self-education items before the end of the income year:

course fees (but not HELP repayments), student union fees, and tutorial fees; and

interest on borrowings used to pay for any deductible self-education expenses.

Also, they could bring forward purchases of stationery and textbooks (i.e., those which are not required to be depreciated).

4. Other work-related expenses

Employees can also prepay any of the following expenses prior to 1 July 2020:

- union fees;

- subscriptions to trade, professional or business associations;

- magazine and professional journal subscriptions;

- seminars and conferences; and

- income protection insurance (excluding death and total/permanent disability).

Note: When prepaying any of the expenses above before 1 July 2020, ensure that any services being paid for are to be provided within a 12 month period that ends before 1 July 2021. Otherwise, the deductions must generally be claimed proportionately over the period of the prepayment.

.jpg)